Disney’s Core Strategy

Over the last ~100 years (founded in 1923) Disney has moved from a niche provider of animated children’s content to the largest and most powerful media entertainment company in the world. This massive growth was fueled by one underlying strategy, tent-pole content. Disney’s tent-pole strategy is to produce, license or acquire a blow-out film with the purpose of supporting a wide range of ancillary tie-in-products around the film and characters.

This strategy has been widely successful for Disney. Just look at Peter Pan, which came out in 1953 (although the original work debuted in 1904 and Disney licensed). It has had more than a dozen follow-on films and still survives today with multiple theme park rides and active theater tours around the world today.

Disney sees its IP (plots and characters) as a fixed cost. And with any fixed cost, the objective is always to use the fixed cost to create as much output as possible. Using this strategy, Disney built up an array of businesses and distribution channels to further monetize on its IP.

- Created theme-parks and resorts (6 parks with 150 million visitors in 2017)

- Started a book publishing

- Built a gaming business

- Created a theater touring group

- Built hotels (over 25 locations and 30,000 rooms)

- Bought three massive cruise liners

- Sold toys and merchandise

- Bought an NHL team (“The Mighty Ducks”) and an MLB team (“Anaheim Angels”)

- And of course, made follow-on movies and series.

In 1984, once Disney had invested significant amounts of capital to build these businesses and distribution channels, it started focusing on broadening its audience outside of outside of youth entertainment. It created Touchstone Films to create more mature content like Pretty Woman and Good Morning, Vietnam. Then Disney went on a content acquisition spree to build its content in the adult and sports markets. Disney acquired or created:

- Hollywood Pictures (1990)

- Miramax (1993)

- ABC/ESPN(1996)

- Fox Family Network (2001)

- Pixar Animation (2006)

- Marvel Entertainment (2009)

- Lucasfilm (2012)

- 21st Century Fox (2017)

Through all of these acquisitions and new units, Disney became the largest entertainment company in the world and now has content for every age group, from toddlers to senior citizens.

Disney was essentially creating a massive positive feedback loop. Because of Disney’s huge physical footprint and distribution channels, it could generate incremental revenue on content above what it’s competitors were able to generate and thereby could afford to spend more money than its competition on generating new content and capital expenditures, thereby continuing and reinforcing the cycle.

Industry Dynamics and Technological Changes

Historically, if you wanted to watch television, your home had to be hooked up to a cable distribution line through local utility poles or underground utility lines. However, cities and counties didn’t like the idea of having tons of cable companies digging through the city laying down cables. So cities limited the number of companies that could provide cable TV to one or two, thereby creating natural monopolies.

These natural monopolies limited content creators ability to have direct access with consumers. The cable technology and business model created two important industry dynamics.

- Linear programming — shows are selected by the broadcaster in advance and then viewed at set times. Viewers cannot fast forward through the content or choose to watch content at a different time.

- Cable companies have control of content — as cable companies control the actual wires that provide homes television, they are able to select what content they want available for their consumers. Cable companies negotiation rates with content producers for specific channels and generally pay a fixed amount per customer even if a customer doesn’t watch that channel.

Historically, these two factors made it so television content catered to the lowest common denominator. Where content was created to have mass-market appeal or appeal to a strong subset of the population, such as sports watchers. Additionally, there was a fixed capacity of content inventory because of the linear programming nature of television.

Both of these dynamics were eliminated with the advent of streaming media over the internet. A distribution channel was opened for content producers to have a direct relationship with the end-user and the end-user was able to have much more control of what they watched. These fundamental shifts lead to three important new industry dynamics.

- Massive amounts of data on users watching patterns — with streaming, companies are able to know exactly how users consume content. They know when and where a show is paused, the exact second that viewers drop-off, and what shows have correlated viewers so they can understand underlying user preferences.

- More personalized content for small sub-groups — as there is no limit to content inventory, more content can be produced for narrower sub-groups of society that typically wouldn’t have been big enough to warrant the cost of creating the content. Thereby the amount of content is significantly increased.

- Increase in the number of content providers — with no entity selecting the specific content the end-users see, more people and companies can create and distribute content and the free market then decides what content is good or bad.

Netflix’s Rise

As most people are quite familiar with Netflix’s historical roots as a mail DVD rental company, I’ll skip over that and focus on how Netflix got to where it is and its core strategy.

Netflix started its online streaming business in 2007 as a content aggregator. End-users pay a fixed monthly subscription and Netflix uses this revenue to secure licensing agreements with content producers for content that Netflix believes it’s end-users want to watch. At the time, content producers, such as Disney, were happy to license their content to Netflix. They saw it as just another way to spread their IP as wide as possible and drive revenue over their fixed costs of creating the IP.

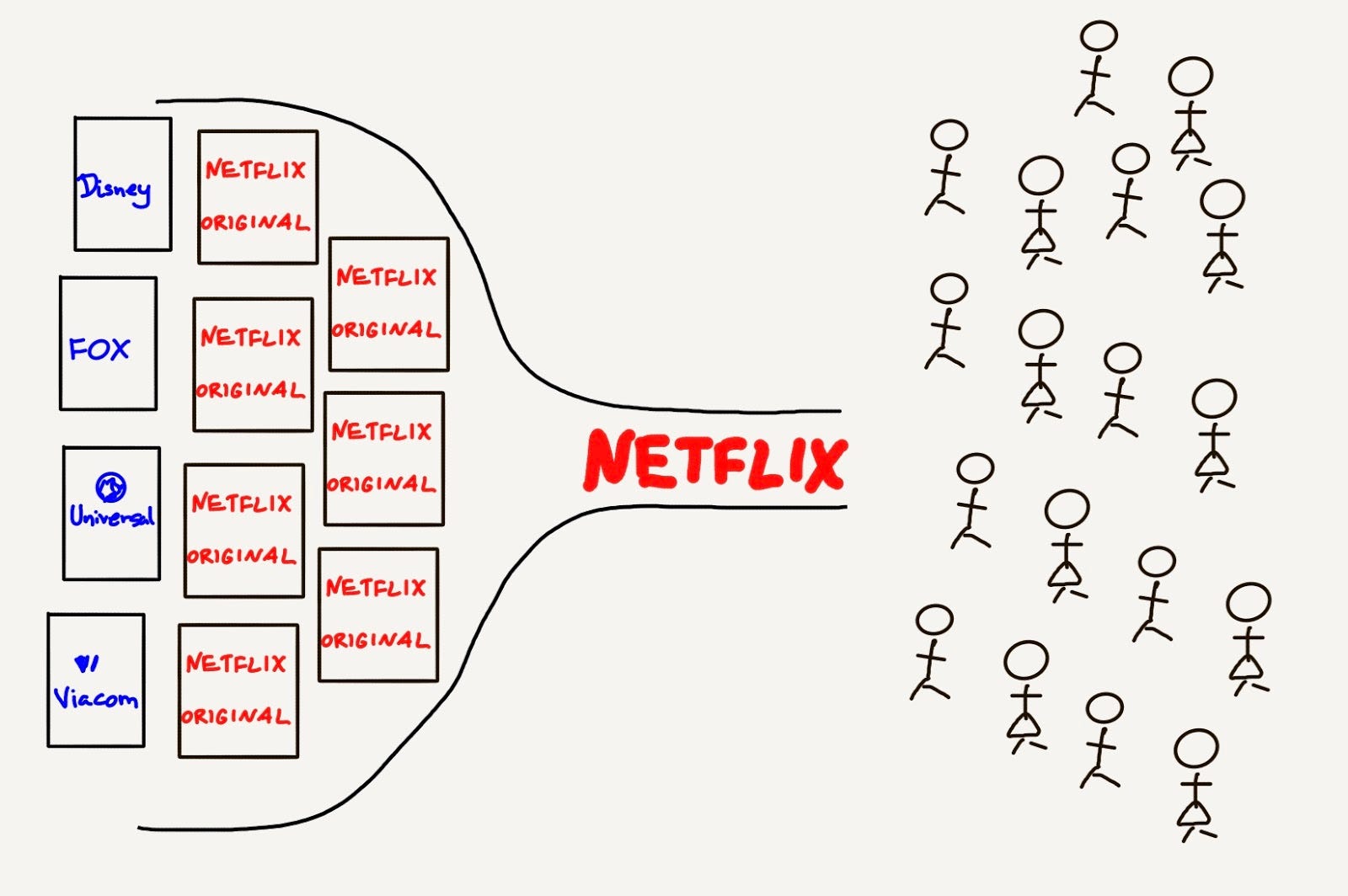

This content aggregation business model was very successful for Netflix, by the end of 2012, it had 27 million subscribers and almost $1 billion in revenue. However, Netflix rightly saw that the business model wasn’t sustainable. It was entirely dependent on content producers, 72% of its revenue went straight to content producers. And the larger Netflix grew, the more these content producers would see Netflix as a threat because Netflix threatened to erode their core television business and Netflix’s brand superseded theirs due to the direct to consumer relationship.

To combat these approaching risks, in 2013, Netflix moved swiftly into creating its own original content, with hit shows like House of Cards and Orange Is the New Black, and both were wildly successful. Fast forward to today and Netflix has 130 million subscribers and is spending $11 billion a year on original content and will release 700+ shows and 80+ new feature films in a single year. For comparison, Disney will only release 10 featured films this year.

Moving forward, I see five core strategies Netflix will use to continue its high growth trajectory.

- Create massives amounts of new content, especially shows — as shows naturally have more hours of content than movies and tend to leave subscribers more in suspense thereby encouraging them more to come back to Netflix on a recurring basis. Additionally, per dollar spent, shows typically produce more airtime than movies as the upfront cost (e.g., creating the set or finding actors) can be spread over multiple episodes and seasons.

- Be the place where content creators want to come — historically, television and big-box-office movies have had more rigid guidelines on what would or wouldn’t be produced. Netflix can provide creators with more free reign because of its non-linear programming and serve as a desirable destination for more creative content and thereby decrease the amount Netflix spends acquiring content.

- Use data to find preference groups and create tailored content for those groups — as I talked about in the industry and technology changes section, data and more personalized content is a cornerstone of streaming content. Netflix will be constantly analyzing it’s user data to find preferences and use that data to inform what types of new shows and films should be created.

- Expand to new target demographics and regional based content — as Netflix increases market penetration, it’ll increasingly look to expand content for other age categories (mainly children) and expand internationally by creating culturally relevant content for different regions.

- Focus on the technology and user experience — Netflix has always focused on providing a simple and powerful user experience down to the smallest elements. For example, a while ago, Netflix introduced the Skip Intro button, because data showed that a lot of consumers try to fast forward during that part and kept having to rewind to because they overshot the intro.

Disney’s Opportunity

The more I think about this competitive landscape and the effects of the technology changes, the more I think that Disney is perfectly set up for success. Disney’s strategy doesn’t need to drastically change, just the delivery mechanism does.

Arguably this new delivery mechanism serves Disney even better. Its brand will be more prominent in front of the consumer and Disney can finally own the direct consumer relationship and provide the exceptional customer experience it’s always provided in its theme parks.

Unlike Netflix, once Disney creates its direct to consumer apps and websites, it’ll immediately have a massive repository of old films and shows to make the product instantly desirable for target segments. And, at the same time, shift the focus of its studios slightly to creating content for that specific delivery channel. Additionally, as Disney has a vast array of other business lines, it’ll be able to spread all that new original content it produces across those other business units to generate additional revenue above and beyond what Netflix is able to do solely in the digital streaming space.

Don’t get me wrong though. Disney’s success certainly isn’t a certainty. In order to succeed in these shifting industry dynamics, Disney will need the right strategic vision and to execute extremely well. I see the following five points as crucial to Disney’s success.

- Create three or four distinct content products. Disney’s greatest asset is its strength of content for huge swaths of user categories. They have content for kids, sports fans, older demographics, sci-fi nerds, non-fiction enthusiasts, and much more. By splitting up this content into many products, Disney can price segregate consumers and increase revenue. There are three obvious content products right now, sports (ESPN), kids (Disney), and more mature content (likely Hulu since Disney now owns ~60% of it). However, in time, with the further deterioration of television, I think they can add a fourth around news content that provides global to hyperlocal content.

- Bundle in other products to the streaming services (think Amazon Prime). This is Disney’s core tent-pole strategy and it should drastically increase because of Disney’s direct access to its consumers. As Disney will have complete control over the user experience, Disney should market, bundle, and discount other Disney products and experiences. A subscription to Disney’s streaming service should be seen as the one-stop-shop for entertainment for children segment and eventually other segments too.

- Keep advertising partially in the equation. Television advertising is a proven marketing medium and moving to streaming only providers more data to make it even more effective. Hulu currently offers two types of subscription packages, one with ads and one without. Disney should look to continue this strategy. The increased data associated with streaming and ability to directly link to advertiser content on-screen will increase the value of ads relative to traditional television. Additionally, having an ad and ad-free subscription allows for more price discrimination to reduce the demand surplus.

- Create significantly more content, especially shows. As I outlined in Netflix’s core strategy, shows are fundamental to keep subscribers engaged and they are the most cost-effective content per hour. This is likely the main reason Disney’s acquired of 21st Century Fox, but Disney will still need to shift some of the studios to churning out more content as well in order to compete with Netflix’s volume.

- Embrace the data and focus on the user experience. Moving to streaming opens a ton of great opportunities for Disney but also comes with a lot of risks. Disney needs to fully embrace its move into digital and adopt the best practices of leading internet companies. Specifically, Disney needs to focus on user experience and A/B testing, building a unified data storage to easily harness data, and, most importantly, moving quickly.

Only time will tell if Disney is able to set the correct strategic vision and execute on it effectively. At the time of writing this post, Disney is set to release its streaming service in late 2019 and it’ll be a year or two after that before we truly know the outcome.